Pallas Capital Advisors LLC reduced its holdings in Planet Fitness, Inc. (NYSE: PLNT – Get Rating) by 69.3% in the fourth quarter, according to its latest filing with the Securities & Exchange Commission. The institutional investor held 3,757 shares of the company after selling 8,500 shares during the period. Pallas Capital Advisors LLC’s holdings in Planet Fitness were worth $298,000 when it last filed with the Securities & Exchange Commission.

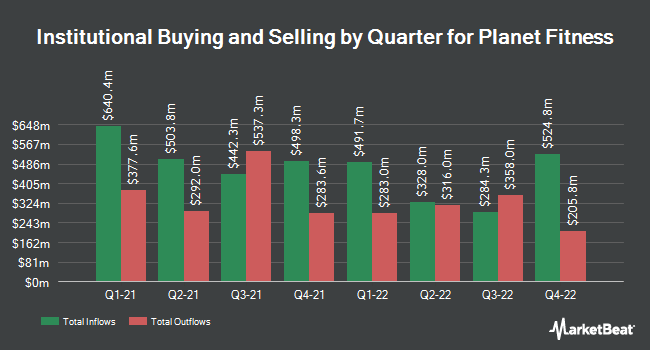

A number of other large investors have also recently changed their positions in PLNT. PNC Financial Services Group Inc. increased its equity stake in Planet Fitness by 13.4% during the 1st quarter. PNC Financial Services Group Inc. now owns 1,332 shares of the company worth $112,000 after purchasing an additional 157 shares during the period. Healthcare of Ontario Pension Plan Trust Fund increased its equity stake in Planet Fitness by 801.5% in Q1. Healthcare of Ontario Pension Plan Trust Fund now owns 1,839 shares of the company worth $155,000 after purchasing an additional 1,635 shares during the period. MetLife Investment Management LLC purchased a new stock position in Planet Fitness during Q1 for a value of approximately $357,000. BlackRock Inc. increased its stake in Planet Fitness by 34.8% in Q1. BlackRock Inc. now owns 7,184,140 shares of the company valued at $606,915,000 after purchasing an additional 1,852,867 shares last quarter. Finally, Vontobel Holding SA acquired during the 1st quarter a new stake in Planet Fitness valued at approximately $919,000. 94.56% of the shares are held by hedge funds and other institutional investors.

Wall Street analysts predict growth

A number of equity research analysts have weighed in on the stock recently. Stifel Nicolaus raised his price target on Planet Fitness shares from $82.00 to $93.00 and gave the company a “buy” rating in a Friday, January 13 report. Robert W. Baird raised his price target on Planet Fitness shares from $100.00 to $105.00 and gave the company an “outperform” rating in a Friday, Feb. 24 report. StockNews.com began covering Planet Fitness shares in a report on Thursday, March 16. They issued a “hold” rating for the company. Morgan Stanley raised its price target on Planet Fitness shares from $92.00 to $93.00 and gave the company an “overweight” rating in a Monday, Feb. 27, report. Finally, Raymond James raised his price target on Planet Fitness stock from $92.00 to $95.00 and gave the company a “Strong Buy” rating in a Friday, Feb. 24 report. Four investment analysts gave the stock a hold rating, eight gave the stock a buy rating and one gave the stock a strong buy rating. According to MarketBeat.com, Planet Fitness currently has a consensus rating of “Moderate Buy” and a consensus price target of $90.67.

Planet Fitness is trading down 1.7%

NYSE: PLNT opened at $76.36 on Tuesday. The company has a market capitalization of $6.83 billion, a PE ratio of 65.26, a P/E/G ratio of 1.44 and a beta of 1.30. Planet Fitness, Inc. has a 12-month low of $54.15 and a 12-month high of $88.31. The company’s 50-day moving average is $79.37 and its two-hundred-day moving average is $73.76.

Planet Fitness (NYSE:PLNT – Get Rating) last released its results on Thursday, February 23. The company reported earnings per share of $0.53 for the quarter, beating the consensus estimate of $0.47 by $0.06. The company posted revenue of $281.30 million for the quarter, versus a consensus estimate of $271.48 million. Planet Fitness had a net margin of 10.61% and a negative return on equity of 65.39%. Planet Fitness revenue increased 53.2% compared to the same quarter last year. In the same quarter of the previous year, the company achieved EPS of $0.26. As a group, analysts expect Planet Fitness, Inc. to post EPS of 2.2 for the current fiscal year.

About Planet Fitness

(Get a rating)

Planet Fitness, Inc is engaged in the operation and franchise of fitness centers. It operates through the following segments: Franchise, Company-Owned Stores and Equipment. The Franchise segment includes activities related to the Company’s franchise operations in the United States, Puerto Rico, Canada, Dominican Republic, Panama, Mexico and Australia.

Further reading

Want to see which other hedge funds hold PLNT? Visit HoldingsChannel.com for the latest 13F filings and insider trading for Planet Fitness, Inc. (NYSE:PLNT – Get Rating).

This instant news alert was powered by MarketBeat’s narrative science technology and financial data to provide readers with the fastest and most accurate reports. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send questions or comments about this story to [email protected].

Before you consider Planet Fitness, you’ll want to hear this.

MarketBeat tracks daily the highest rated and most successful research analysts on Wall Street and the stocks they recommend to their clients. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the market takes off…and Planet Fitness wasn’t on the list.

While Planet Fitness currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

See the five actions here

Elon Musk’s next move

Wondering when you can finally invest in SpaceX, StarLink or The Boring Company? Click the link below to find out when Elon Musk will finally let these companies go public.

Get this free report