- Ambus Hunter, 36, said he nearly went bankrupt when he became addicted to gambling more than a decade ago.

- His net worth is now around $600,000 and he works part-time as a financial coach.

- He said players had to be very careful and his path to riches required a lot of sacrifice.

In 2011, Ambus Hunter said his only debt was a car lease and he had $2,000 in savings – then he traveled to Las Vegas for the first time.

He became fascinated with the “ups and downs” of roulette, he told Insider. When he returned home to Ohio, he continued to gamble regularly at casinos in Indiana and Pennsylvania.

At first, it was all fun and games. By November, about six months after his trip to Vegas, he had more than $11,000 in savings, according to bank statements seen by Insider. But then things quickly fell apart.

He said he saw his losses pile up but he couldn’t stop. In just four weeks, he said he lost around $10,000 – almost all of his savings – playing roulette.

Hunter recalls a November evening when he withdrew a significant portion of the money left in his bank account and told himself he would only play one last time. He said he lost half of it in 30 minutes, then burned some more before leaving the casino with “maybe a few hundred” dollars left over.

That night, he said the reality that he was almost “out of money” finally set in, and he vowed to beat his gambling addiction.

“I had become so obsessed with the game that I didn’t take care of myself. I wasn’t eating, I wasn’t sleeping, I was losing focus at work and, for the first time in my life, I was running late. on a credit card bill,” he said, adding, “I needed to make a change before I dug a hole I couldn’t get out of.”

More than a decade later, that hole is starting to become a distant memory.

Today, the 36-year-old from Baltimore has a net worth of around $600,000, according to various documents seen by Insider, which reflected around $750,000 in savings and investments and $140,000 in mortgage debt. . He works as a program manager for the US Department of Defense and has a part-time position as a certified financial advisor.

Hunter said he had a major setback since committing to stop playing, but was able to get back on track. Looking back, he said he should have sought more resources to fight gambling addiction, but was too “embarrassed” and “stubborn” to do so at the time.

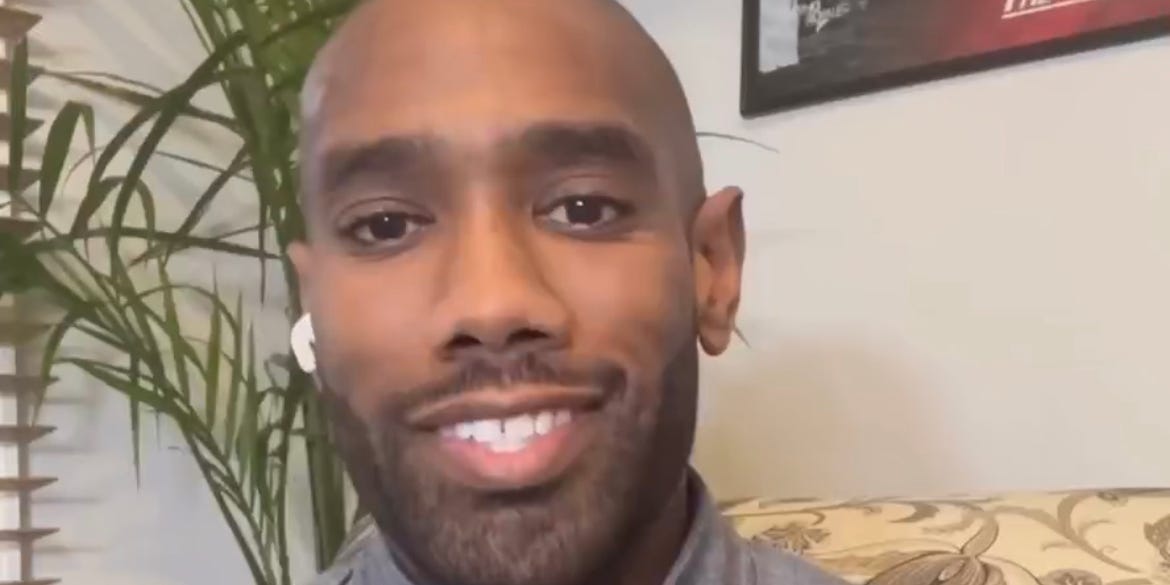

Hunter.

Ambus Hunter

How to get out of a big financial hole

After quitting gambling, Hunter said the first important step was to take responsibility for the situation he put himself in and accept that he would never get back the money he lost at the casino.

“I didn’t blame myself, I just took ownership of my decisions and my reality,” he said. “It actually gave me peace that if I got myself into this mess, I could get out of it.”

He said he set out to quickly replace the approximately $10,000 he had lost.

To do this, Hunter ditched cable and home internet. Instead, he said he attached his cellphone data. He said he’d stopped dining out, lowered his thermostats, limited his social life and spent nothing he deemed ‘non-essential’, which he said was about it except rent, groceries, utilities, gas to get to work, and car payment.

In addition to working full-time, Hunter said he took on two part-time gigs as a mystery shopper and brand ambassador.

Four months later, he had $10,000 in savings, according to bank statements seen by Insider, but he didn’t stop there.

For those looking to save, Hunter offered three tips: Be “crystal clear” about your financial goals, make a plan for your money each month and stick to it, and “take advantage of automation where possible” with to automatic savings mechanisms like paycheck direct deposits and 401(k) contributions.

“Casinos and gaming platforms are designed to keep you coming back”

When it comes to gambling, Hunter said he would tell all of his customers to “proceed with caution”, especially given the increase in access to gambling – much of it related in sports betting – across the United States.

“Casinos and gaming platforms are designed to keep you coming back. Gambling addiction activates the brain’s reward system the same way drugs do, so it’s important to understand the risks of developing an addiction,” said he declared. “Everyone needs to find a healthy approach that works for them. For some, that may mean abstaining 100 percent.”

In addition to his experience, Hunter’s claim is supported by research. Timothy Fong, co-director of UCLA’s gambling studies program, previously told Insider that sports betting, in particular, is “a product that we know is addictive.”

“Here is an American appetite for this product,” he added. “And then you combine the strengths of a very powerful and efficient industry combined with technology. That’s where it could potentially go wrong.”

After his experience, Hunter worries that the gambling boom in the United States will have major consequences for some people.

“Unfortunately, some people are going to end up with their lives negatively altered forever,” he said. “This level of promotion and access to gambling, especially through our mobile phones, is very new in our society. And every time we get a shiny new ‘thing’, we tend to over-consume.”

He added: “I’m not trying to shut down the industry. But we also need to focus on education so people can really gamble responsibly and feel supported if they need help. “

Have you struggled with a gambling addiction and are you ready to share your story? If yes, reveryone to this reporter at [email protected].