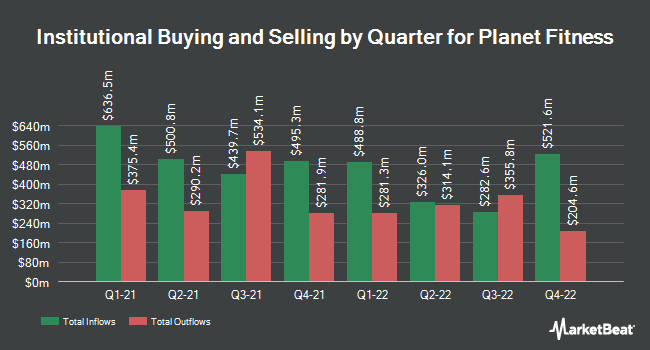

Strs Ohio bought a new stock position in Planet Fitness, Inc. (NYSE: PLNT – Get Rating) during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor purchased 320,000 shares of the company, valued at approximately $25,216,000. Strs Ohio held 0.36% of Planet Fitness when it last filed with the SEC.

A number of other hedge funds and other institutional investors have also recently changed their stock holdings. Sandy Spring Bank increased its position in Planet Fitness by 25.0% in Q3. Sandy Spring Bank now owns 2,500 shares of the company worth $144,000 after acquiring 500 more shares in the last quarter. Tudor Investment Corp Et Al purchased a new stake in Planet Fitness during Q3 for $8,260,000. Engineers Gate Manager LP purchased a new stake in Planet Fitness during Q3 valued at $2,054,000. MQS Management LLC acquired a new stake in Planet Fitness during Q3 valued at approximately $242,000. Finally, Ergoteles LLC purchased a new position in Planet Fitness during Q3 at a value of $866,000. Institutional investors and hedge funds hold 94.56% of the company’s shares.

Changes to analyst ratings

The PLNT has been the subject of a number of recent research reports. Robert W. Baird raised his price target on Planet Fitness from $100.00 to $105.00 and gave the company an “outperform” rating in a Friday, February 24 research note. Stifel Nicolaus raised his price target on Planet Fitness shares from $82.00 to $93.00 and gave the stock a “buy” rating in a Friday, January 13 research note. DA Davidson reaffirmed a “neutral” rating and posted a price target of $87.00 on Planet Fitness stock in a research note on Friday, February 24. Morgan Stanley raised its price target on Planet Fitness from $92.00 to $93.00 and gave the stock an “overweight” rating in a Monday, February 27 report. Finally, Piper Sandler raised her price target on Planet Fitness from $79.00 to $93.00 and gave the stock an “overweight” rating in a Thursday, December 22 research report. Four investment analysts gave the stock a hold rating, eight gave the stock a buy rating and one gave the stock a strong buy rating. According to data from MarketBeat.com, Planet Fitness currently has an average rating of “Moderate Buy” and an average price target of $90.67.

Planet Fitness Stock Performance

Shares of NYSE PLNT opened at $75.90 on Friday. The stock has a market capitalization of $6.79 billion, a P/E ratio of 64.87, a P/E/G ratio of 1.42 and a beta of 1.30. The company has a 50-day moving average price of $79.01 and a 200-day moving average price of $73.87. Planet Fitness, Inc. has a 52-week minimum of $54.15 and a 52-week maximum of $88.31.

Planet Fitness (NYSE:PLNT – Get Rating) last announced its results on Thursday, February 23. The company reported EPS of $0.53 for the quarter, beating the consensus estimate of $0.47 by $0.06. The company posted revenue of $281.30 million for the quarter, versus a consensus estimate of $271.48 million. Planet Fitness had a net margin of 10.61% and a negative return on equity of 65.39%. The company’s quarterly revenue increased 53.2% year over year. During the same period last year, the company posted EPS of $0.26. Analysts predict Planet Fitness, Inc. will post 2.2 earnings per share for the current fiscal year.

About Planet Fitness

(Get a rating)

Planet Fitness, Inc is engaged in the operation and franchise of fitness centers. It operates through the following segments: Franchise, Company-Owned Stores and Equipment. The Franchise segment includes activities related to the Company’s franchise operations in the United States, Puerto Rico, Canada, Dominican Republic, Panama, Mexico and Australia.

Learn more

Want to see which other hedge funds hold PLNT? Visit HoldingsChannel.com for the latest 13F filings and insider trading for Planet Fitness, Inc. (NYSE:PLNT – Get Rating).

This instant news alert was powered by MarketBeat’s narrative science technology and financial data to provide readers with the fastest and most accurate reports. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send questions or comments about this story to [email protected].

Before you consider Planet Fitness, you’ll want to hear this.

MarketBeat tracks daily the highest rated and most successful research analysts on Wall Street and the stocks they recommend to their clients. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the market takes off…and Planet Fitness wasn’t on the list.

While Planet Fitness currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

See the five actions here